By Nomtha Ngumbela

There have been many turning points in the South African economic growth story starting with the move from an agriculturally based economy to a country know dubbed the most industrialized in the African continent. During this time South Africa has met some challenges such as rolling blackouts in the form of load shedding, the financial crisis of 2018, a weakening employment rate and most recently the arrival of the Corona Virus to our shores. It comes as no surprise then that our economy, as measured by the annual Gross Domestic Product (GDP) has been unable to expand beyond 2% since 2013.

The South African Economy

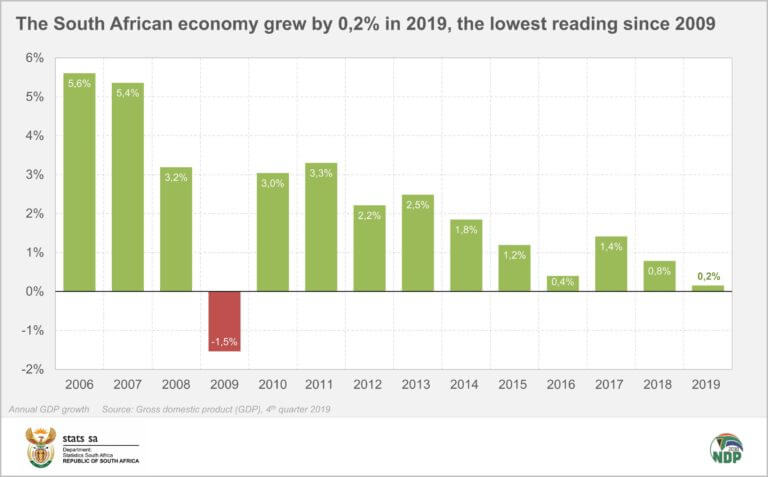

In 2019, the South African economy displayed a flat expansion rate of 0.2%, the lowest since 2019 when SA recorded a contraction of -1.5%. ( see below graph). There was therefore much hope that South Africa had reached its most painful point at the end of last year. Economists and analyst poised 2020 to be a year that would bring greater prosperity and with some luck, policy reforms that encouraged further commercial activity, allowing the GDP to climb to a projected rate of between 1-1.5%. The optimism around what I believe could have been a fairly positive recovery was unfortunately compromised by Covid-19. The current forecasts for South Africa’s GDP in 2020 all look towards a strong contraction for the year, with the National Treasury predicting amongst the most buoyant figures at -7.2%.

The above introduction is not an attempt to draw a ‘gloom and doom’ picture for the reader, but rather to provide some context to what may or may not have happened to your locally focused pension funds and investments over the past 7 months or so.

Where did all my money go?

If like many you had a peek at your pension fund statement during the beginning of lockdown, you may have found yourself in serious despair. If you recall, when the lockdown was first imposed economic activity in South Africa by in large came to halt. The uncertainties about the ramifications of contracting Covid-19 were not known locally or globally and a vaccine was far from being developed. As a result, Financial Markets reacted badly to the increased uncertainty in the world, with many investors selling their stocks in favour of safe havens such as Gold and cash. The result? A decrease in stock prices leads to a decrease in your retirement savings as well as a decrease in your locally focused investment portfolio.

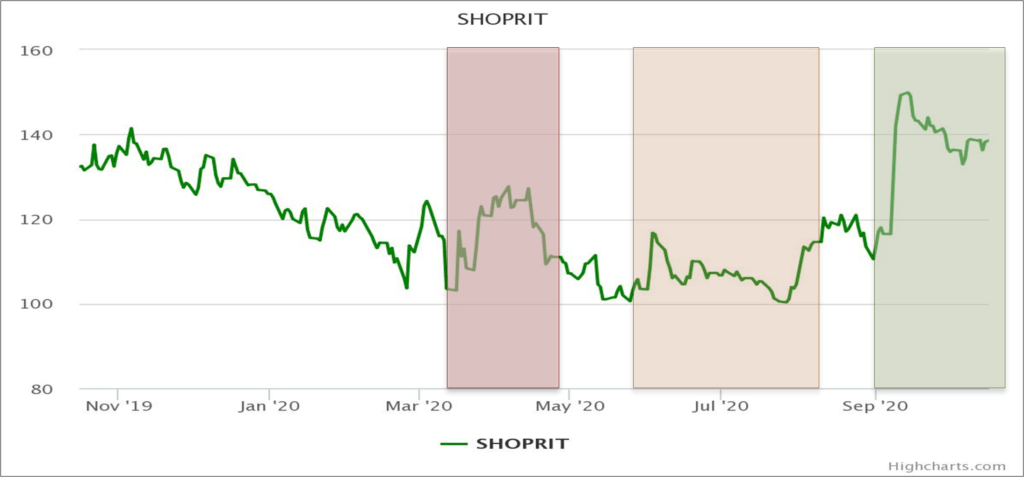

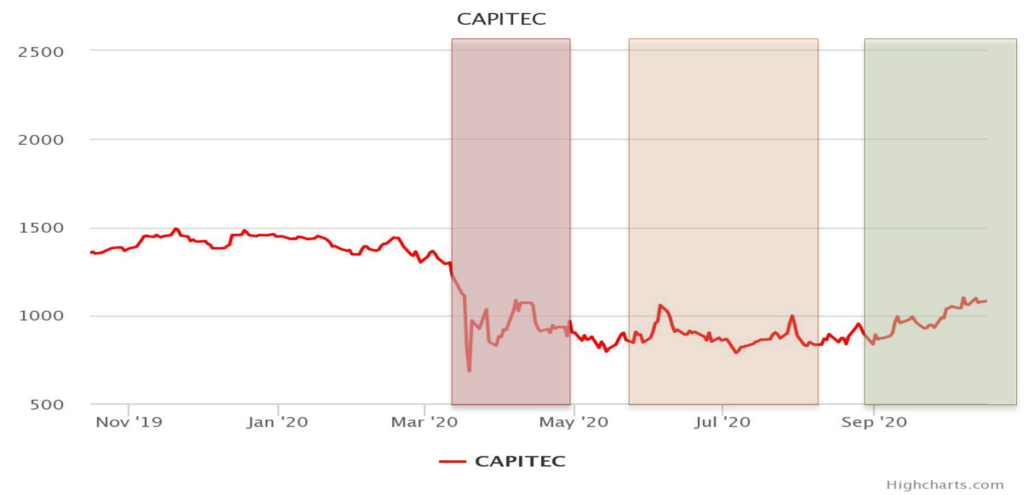

Though the erosion of your retirement savings does entice fear in investors, it is important to remember that financial markets move in cycles and shares are one of the most heavily affected asset classes, both to the upside and the downside depending on where the economy is in an economic cycle. This is not to say that in the next 6 to 12 months your retirement portfolio will recover to pre-covid levels but rather to point out that the recovery of local financial markets is happening albeit slow and steady. If you have considered cashing out of the stock market given the increased fear of reading your monthly statement, the below price-performance graphs of Shoprite and Capitec may tell a story of why panic-selling your equities at this moment, may not be the most intelligent choice, especially for a young investor.

Share Insights: Hard Lockdown to Level 1

On the 27th of March 2020, President Ramaphosa implemented the first and hardest phase of lockdown to curb the spread of the coronavirus. South Africa moved to various levels as per the below:

- 27 March 2020 – Initial Lockdown

- 1 May 2020- Level 4

- 1 June 2020- Level 3

- 17 August 2020 – Level 2

- 21 September 2020 – Level 1

Shoprite Holdings Ltd (JSE:SHP) – Share Price Performance

On the 27th of March Shoprite’s (SHP) share price was trading at R120.86. At its lowest point on the 27th of July, the share sat at around R100.28 , an over 17% drop! Since this bottom point, the share has recovered 38.2% in line with the reopening of the economy and is performing at its highest range since the year started(green block).

At the beginning of the year, Capitec’s share price reached highs of R1 469.91 per share (17th of January). However, the stock lost over 50% of its value during the hard lockdown (red block) to land at a price of R682.5. The stock has since recovered above the thousand rand threshold but Capitec provides a strong case for the volatile movement of share prices during the pandemic which could’ve easily prompted the strong movements of your investment portfolio where the stock was heavily weighted.

Conclusion

It is true that we live in strange and uncertain times from working environments to shopping experiences all of which can cause unparalleled concern about the direction of the future. At this point in time, no one can predict what financial markets or the South African economy will look like in the next 6 to 12 months but we can some comfort in the fact that economic troughs do not last forever.

The purpose of this series is to begin building a vault of investing knowledge for our readers, which will allow you to have a better understanding of your investments. Though this is a strong starting point, ultimately Ubumbo hopes to empower you, the investor, to make more informed decisions about money and work diligently to build your long-term wealth. As such, if there are questions or themes that the reader would like the investment writing team to answer or cover in more detail, please feel free to reach out to us.